Oosterhout, 31 January 2022 – Tulp Hypotheken and BNP Paribas Cardif are collaborating. Advisors applying for a Tulp Mortgage are automatically informed of the possibility of applying for a BNP Paribas Cardif Surety Ship, quickly and easily. The BNP Paribas Cardif application process is completely digital, which is in line with the efficient mortgage process of Tulp Hypotheken.

With the interest rate offer from Tulp Hypotheken, the customer and advisor are immediately informed about the Surety Ship of BNP Paribas Cardif. The advisor then discusses this with the customer. Next, the advisor uploads the purchase agreement. After which the customer receives the application digitally and signs it via iDIN.

Marieke van Zuien, CCO BNP Paribas Cardif Belgium and the Netherlands:

“As the insurance partner, we like to work with strong players in the market. That is why I am very pleased that Tulp Hypotheken is bringing the Surety Ship to the attention through their interest offer. Adding this to their process makes it even easier, more accessible and more efficient for advisor and customer to request a Surety Ship.”

Robert van Lambalgen, Sales Manager of Tulp Hypotheken:

“With the interest rate offer of the new Tulp Complete Mortgage, the Surety Ship is brought to the attention of customer and adviser. With this mortgage, Tulp offers a product with excellent conditions. In addition, one of our main goals is to make it as easy as possible for advisors and clients. By pointing out the BNP Paribas Cardif Surety Ship in our process, we are one step closer to achieving this goal.”

Oosterhout, January 25, 2022 – Bidding without the condition of subject to funding is increasingly happening in this overheated housing market, which can cause major financial risks. Potential buyers try to get hold of their dream home by significantly overbidding and omitting the condition of subject to funding. Often without knowing for sure whether they will be able to get the mortgage. With ‘Bid with Certainty’, the customer can now bid safely and responsibly.

Financial setup before making a bid

By bringing the inventory of the feasibility and affordability of the mortgage forward in the process and because an accurate valuation of the property is made, the customer knows in advance how much he can responsibly bid on the home. Irresponsible bidding is prevented by explicitly stating the amount up to which BNP Paribas Cardif guarantees. Has the offer been accepted? Then the (bank) guarantee is provided within a few days after the purchase contract has been signed. Couldn’t the customer get a mortgage? In that case, BNP Paribas Cardif will reimburse the guaranteed amount.

Collaboration between De Hypotheker and BNP Paribas Cardif

After Bidding with Certainty has first been tested, the product is now available nationwide at all De Hypotheker branches. De Hypotheker provides independent financial advice and BNP Paribas Cardif provides the insurance and the (bank) guarantee. In addition, partners Hera Life and Woongarant play an important role in the application process.

Marieke van Zuien, Commercial Director BNP Paribas Cardif in Belgium and the Netherlands about Bidding with Certainty: “We want to help consumers make a better offer and thus realize their housing wish. For us, it was paramount that this is done in a safe and responsible way. By explicitly stating the amount up to which we guarantee, we prevent consumers from making irresponsible bids. This reduces the risks in the housing market. Our unique business model is anchored in partnerships. Co-creating with partners is in our DNA. This collaboration with De Hypotheker is therefore an excellent fit for us as a partnership insurer.”

Menno Luiten, Commercial Director De Hypotheker: “We are very pleased that together with our business partner BNP Paribas Cardif we can immediately respond to the changing needs of our customers in the current overcrowded housing market. Bidding with Certainty covers the financial risk of bidding without the condition of subject to funding. This makes Bidding with Certainty a unique offer in the mortgage market where the customer has a better chance of acquiring his dream home, without an increase in financial risk”.

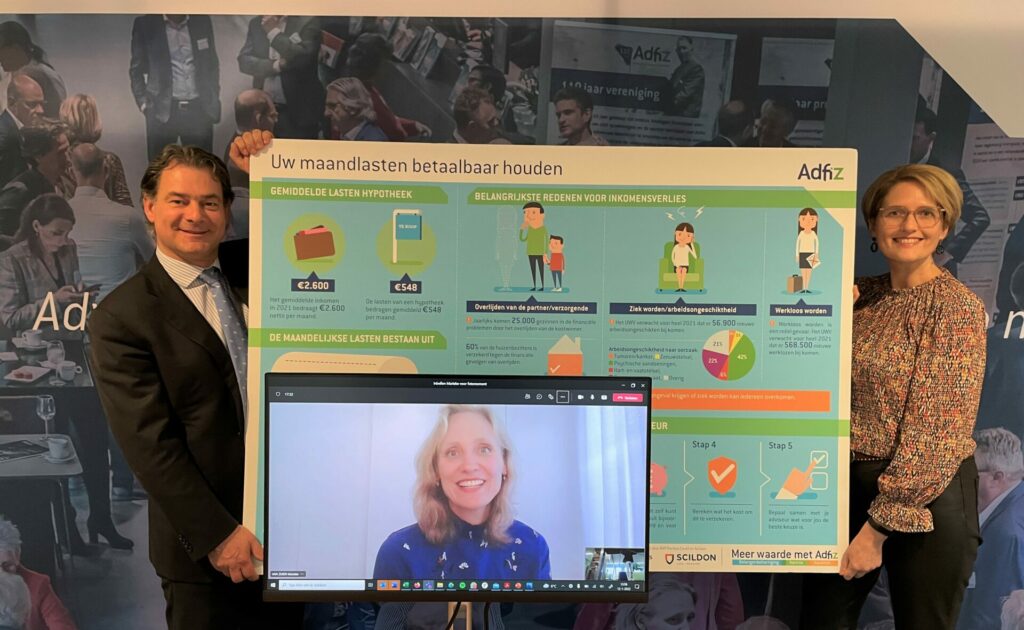

Half of all Dutch households are financially vulnerable. No fewer than 75,000 households will run into payment problems within 3 months if an income were to be lost. Every year, 25,000 families run into financial difficulties due to the death of a breadwinner. Too often death, job loss or incapacity to work means that a household can quickly no longer afford the monthly costs. With more attention to their own finances, this is not always necessary, which is why Adfiz, BNP Paribas Cardif and Scildon have joined forces. Together with financial advisors, they will draw attention to these risks. With short videos, infographics and postcards, they want to help consumers start the conversation.

Money matters are in the top 3 of New Year’s resolutions every year. These are often very practical and tangible resolutions. The majority (41%) want to save for a buffer. Less unnecessary spending (36%) and being more frugal (35%) are also popular, according to research by Wijzer in Geldzaken. More is often needed to be financially prepared for impactful events. Sometimes the risks are so great that insurance is necessary. At the moment, this is not yet the case in many situations. For example, 60% of homeowners and 31% of tenants have insurance against the financial consequences of death. Less than 5% of homeowners have mortgage insurance against loss of income due to disability and unemployment, while the decline, despite the social safety net, may be too great to be able to continue to pay existing (fixed) monthly payments. This does not only apply to consumers with lower incomes. But especially among young dual earners who are currently often dependent on living space with (very) high rents.

Insight

Adfiz director Enno Wiertsema: “It is difficult for many people to properly estimate a real risk. And the solution requires more than online calculation tools or just taking out a policy. It really starts with awareness and insight. You have to dare to confront yourself and answer very honestly to questions such as: what do I want to be able to continue to do, how important is it that I can continue to live here, what income may be lost, how big is my buffer really. It makes no sense to count yourself rich, but how do you avoid arranging more buffers and insurance than necessary? Advisors are pre-eminently capable of holding up that mirror.”

The three organizations outline a 5-step plan for advisors and their clients to deal with these risks.

Step 1: Calculate what you need each month

Step 2: See what the financial consequences are if something happens to you

Step 3: See if you can catch it yourself and for how long

Step 4: Check whether you can (partially) insure it and what that costs

Step 5: Decide what is the best choice for you

High costs of living

Marieke van Zuien (CCO BNP Paribas Cardif Belgium and the Netherlands) points out the extra risks in the current housing market:

“Certainly now that there are often outbids and greater risks are taken, it is very important that consumers discuss the impactful risks with their adviser. The consequences of illness, death or unemployment can be enormous. Consumers often underestimate these risks. That is why it is essential to carefully determine with the adviser how the client prepares financially for those possible situations.”

More than a mortgage and insurance

Ingrid Oudhuis (Director of Businessline Particulier Scildon) points out the importance of a realistic view of risks:

“The social value of the financial advisor is that they also enter into discussions with their clients about financial subjects that clients themselves do not give enough thought to. The financial impact of death on the next of kin is one such topic. Whether it concerns young people in expensive rental homes, families in owner-occupied homes where the income of both partners is needed to pay the housing costs, the security of alimony or in a business setting the unexpected death of a partner in the company. In practice, it is the advisor who explains and advises clients to do what is sensible for them. Scildon believes in the added value of the advisor. With the step-by-step plan developed, the advisor can map out the financial risks together with his clients. And advise them on a suitable solution.”

Visit here for all information, video’s and infographics.