Dutch highlights of BNP Paribas ESG Global Survey show major shift in active ownership amid concerns about the quality of ESG data and its politicisation.

BNP Paribas is proud to present the main ESG trends observed among institutional investors in the Netherlands in 2023. This NL view delves into the Dutch data from BNP Paribas’s ESG Global Survey 2023, showing where it either follows or bucks the trend in the rest of Europe and worldwide. Here are some of what we see as the most interesting results.

[Based on a Dutch cohort of fifteen asset owners, twelve asset managers and three hedge funds and private equity firms, the localised results of the global survey essentially take us through the life cycle of ESG data at institutional investors in the Netherlands, from its supply to its place in investment decisions and its incorporation into operations. ]

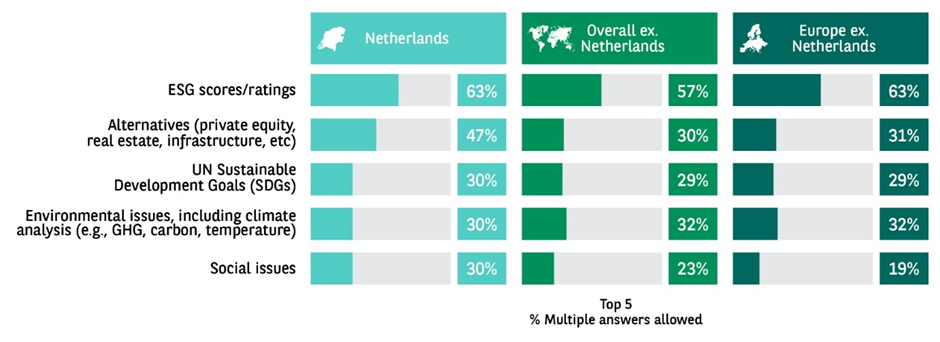

Starting with where they get their ESG data, Dutch institutional investors are more likely to use ESG data vendors for alternative assets and social issues than their European and worldwide counterparts. This reflects social issues, in particular, moving higher up on Dutch agendas.

For which of the following areas do you use an ESG data vendor for analysis and information?

Nikkie Pelzer, Impact Manager, Triodos Investment Management says that regarding their ESG efforts over the past two years: ‘Triodos, as a bank and an asset management company, has a truly holistic approach, always looking for both social and environmental impact. …We launched, for example, a fund focused on renewable energy in emerging markets, able to offer clean energy solutions to emerging market countries. We also launched a fund in support of UNICEF, focused on children’s rights. Being able to launch those new propositions was a great way to further expand our holistic approach’

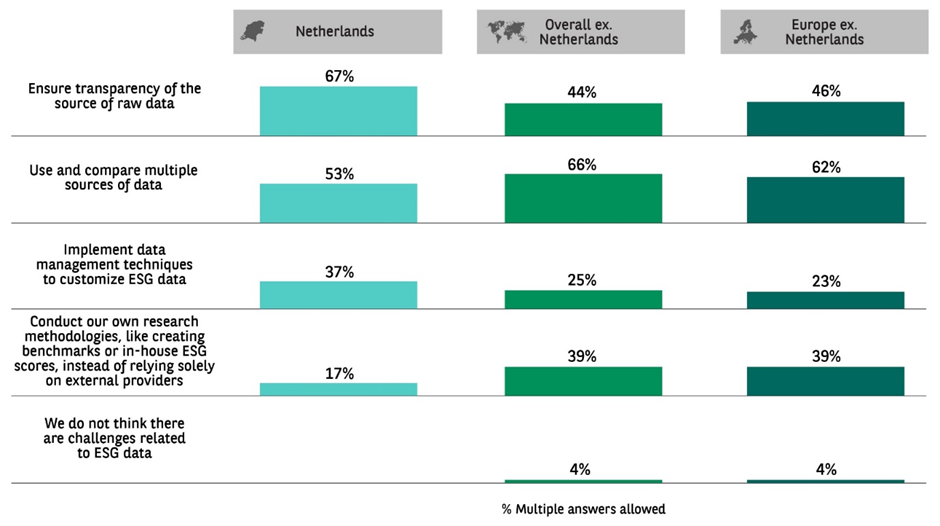

Yet as fewer Dutch institutional investors have in-house research methodologies for ESG data, they are far more concerned with having a transparent source of data than their peers.

Which of the following steps does your organisation take to get around data challenges relating to ESG?

In fact, almost three quarters perform heavy data quality checks.

Nikkie Pelzer adds: ‘If you look at our listed investments, we rely on sustainability information from data vendors. Acquiring that data is needed for us to be able to do the right assessments’

This makes them more sensitive to the rising cost of ESG data, which worries 60% of Dutch respondents compared with 38% worldwide and 43% in the rest of Europe. So whether it’s the cost or analysing its quality, all Dutch respondents struggle with ESG data – a sentiment that, to one degree or another, is shared by practically all institutional investors around the world.

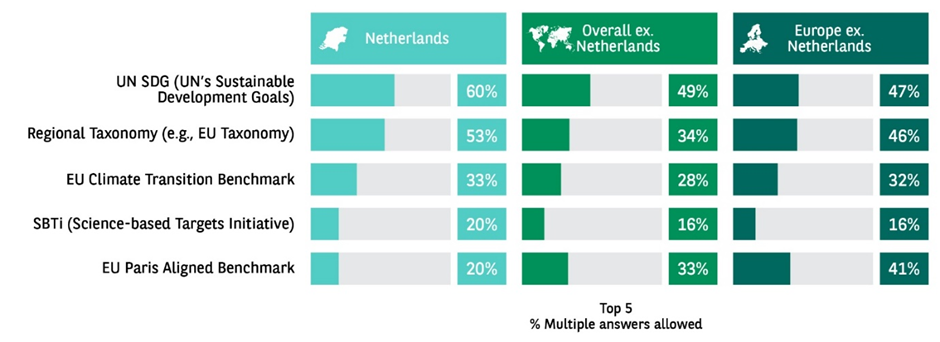

When it comes to the actual place of ESG in investment decisions, 60% of Dutch respondents say they invest according to the UN’s SDGs. That’s higher than those doing the same in the overall (49%) and even the European (47%) categories.

For the following frameworks for sustainable investing, or reporting on sustainable investing, does your organisation use them now and/or does it plan to do so in the next two years?

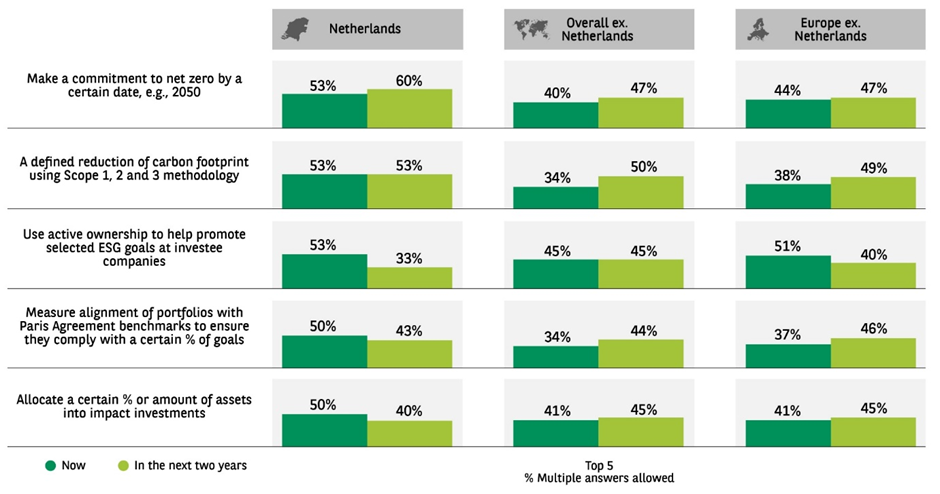

There’s also more reliance on the EU Taxonomy, indicating that Dutch institutional investors are keen to help meet global sustainability objectives and comply with European legislation. Commitments to net zero by a certain date are, however, equal across the board, but in the Netherlands the use of active ownership to fulfil those commitments will drop from 53% today to 33% in the next two years. That’s steeper than in other countries.

What are your organisation’s key ESG objectives both now and in the next two years? Please select all that apply.

Dutch institutional investors are also more focused on ESG regulation and reputational risks, not to mention the financial materiality of biodiversity loss, which is 40% in the Netherlands compared with roughly 30% elsewhere.

Lars Dijkstra, Chief Sustainability Officer, Van Lanschot Kempen sees their active ownership evolving in the next couple of years: ‘We are focusing on climate and biodiversity as themes, and that has to do with the energy transition. Health will be a topic going forward, which we translate into the food transition in that it is interconnected with biodiversity. And the third theme is circular economy and that translates into the materials transition. For now, we are focussing only on the energy transition and hence climate and biodiversity, but we will develop those other themes in the next few years. That’s the roadmap, but we take it step by step.’

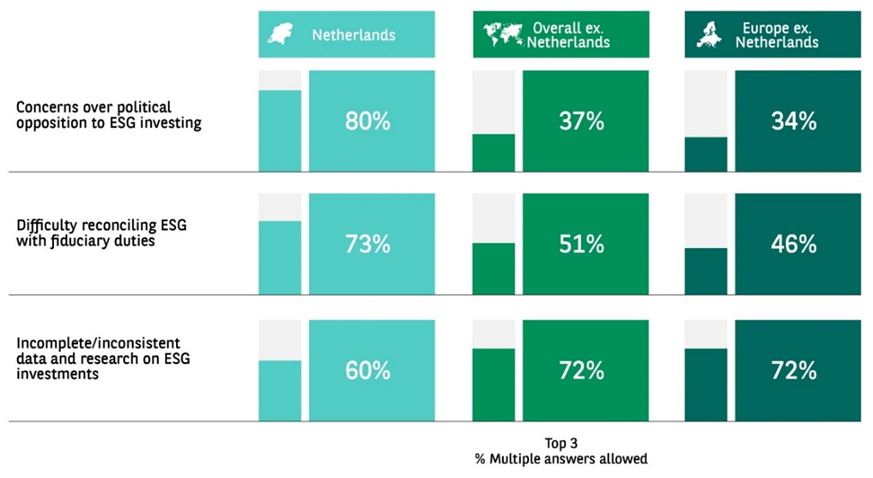

And at the far end of the spectrum are Dutch worries about the politicisation of ESG, which are reported by a staggering 80% of Dutch respondents compared with 37% overall ex. NL and 34% Europe ex. NL and could curtail their long-standing support for sustainable investment.

What are the most significant barriers to greater adoption of your ESG strategy across your investment portfolio today?

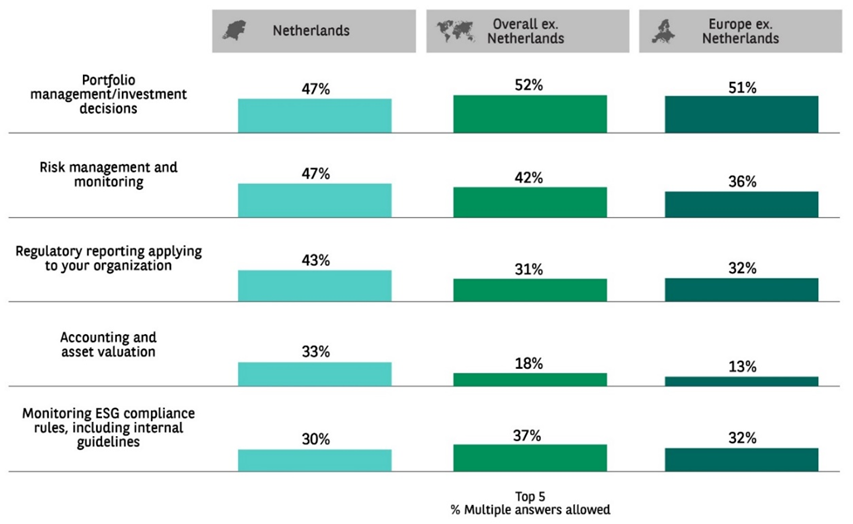

On the other hand, the integration of ESG into operating models sees a more unified trend. Almost half of Dutch respondents say they integrate ESG expertise and data into their portfolio management, investment decisions and risk management. This is slightly lower than in the other two cohorts for portfolio management integration but slightly higher for risk management (47% compared with as low as 36% in the rest of Europe).

Has your organisation integrated ESG expertise and data into any of the following investment-related operations?

Marietta Smid, Senior Manager Sustainability at ASN Impact Investors comments: ‘ASN Impact Investors uses sustainable exclusion criteria from since its inception. At a certain point, we decided to develop our sustainability policies and operations around three main pillars: human rights, climate change and biodiversity. Of course, we also look at welfare and good governance at companies. We don’t lower our standards for specific clients; there is a minimum standard.’

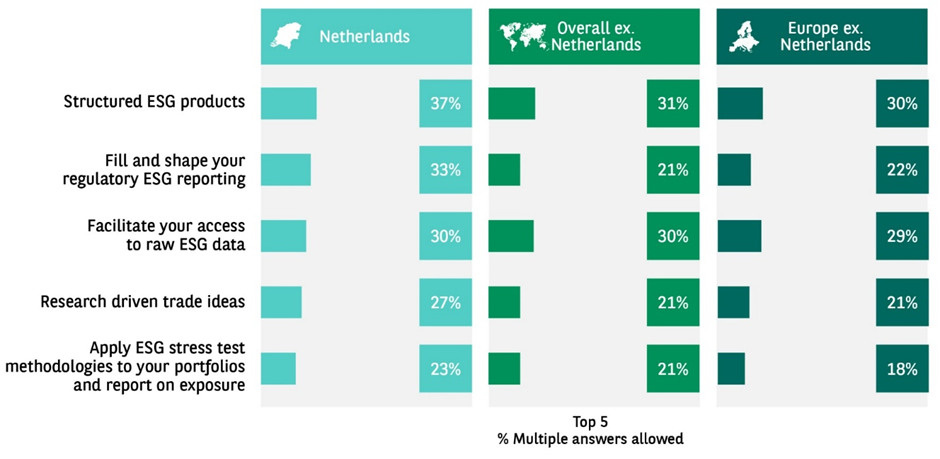

It’s also interesting to see how banks like BPN Paribas can help them on their transition to sustainability. While slightly more institutional investors in the Netherlands would seek the help of a bank for their structured ESG products (37% compared with about 30% elsewhere), the preoccupation with regulation is raised here again as a higher percentage of them would turn to banking partners to shape their ESG reporting in particular (33% compared with about 20%).

For which of the following areas is your organisation using, or would consider using, a banking partner/provider?

And when it comes to choosing that banking partner, Dutch respondents say brand reputation for ESG is the deciding factor – which we can’t deny is positive from our perspective.

The question now is how these trends will play out in the future. The Netherlands has long been considered a pioneer in sustainable investing, so will the move away from active ownership, for instance, start to gain even more traction in the rest of the world as it has in the Netherlands? And what about the increasing prioritisation of social issues in ESG investing? How far will that go, and to what extent might that be shaped by leading Dutch perspectives? Only time – and the results of the next survey – will tell.