Client Support

BNP Paribas Corporate & Institutional Banking

Here to help

Service topics on this page

Welcome to the Client Support page of BNP Paribas Corporate & Institutional Banking in the Netherlands.

As your Client Services team it is our mission to provide you with the best possible support when using our products and services. You can always contact us directly with any query that you might have, either via email or by telephone, using the contact details as listed on the contact us page.

Compliance and Regulatory Requirements

What regulatory requirements are applicable to BNP Paribas Netherlands?

BNP Paribas Netherlands is obliged to comply with International and Dutch legislation governing financial institutions. A comprehensive set of measures is provided to prevent money laundering, terrorist financing and other illegal activities. In addition financial institutions must comply with all sanction regulations, targeting entities, persons, goods and/or countries. In this respect BNP Paribas Netherlands is obliged to know their customers and to monitor their customers’ accounts and transactions.

What information is important to provide when submitting a payment?

In light of our regulatory requirements (see above), BNP Paribas Netherlands might request additional detailed information about incoming or outgoing payment flows.

To reduce the number of inquiries on transactions, it is highly recommended to mention a clear economic purpose in the payment reference field. An economic purpose should be a detailed description of the goods, services or reason for the payment. For incoming payment flows this can be achieved if our clients instruct their paying parties to state a clear economic purpose in payments. In case of outgoing payment flows, we advise to always use the full name and address of the final beneficiary.

Where can I see if one of my outbound payments is on hold for compliance reasons?

BNP Paribas offers within the CENTRIC environment the APP Inquiro for digital exchange of additional payment information. In a secure and centralized environment the APP provides instant notifications on payments that are on hold for compliance reasons. It improves autonomy and end-to-end transparency by centralizing all payments for which BNP Paribas or any third bank require additional information. It also offers an auto-allocation and delegation functionalities to assign the requests to the correct person or team within your organization.

Where can I find up-to-date information on the regulatory requirements and the limitations to the processing of payments with certain countries applicable to BNP Paribas Netherlands?

Please visit this site and those of the authorities on a regular basis to verify that your information is still up to date. A complete overview can be found on the below websites:

All of the above mentioned information is subject to change, and the required additional information is not per se limited to the above mentioned. We would also like to make a reference to Article 2 of the ‘General Banking Conditions’ that covers the ‘Duty of Care’ of BNP Paribas Netherlands and Article 17 concerning ‘Information and orders’.What constitutes a duly-signed document?

In order for a document to be duly signed it should be signed in line with the following guidelines:

- Option 1: By the directors listed in the Chamber of Commerce Extract. One individual in the case of sole authorization, two persons in the case jointly authorized or as otherwise stated in the Articles of Association.

- Option 2: Individuals that are empowered to represent the company towards BNP Paribas SA by means of a Power of Attorney. The power of attorney should be signed by the director(s) of the company as listed in the Chamber of Commerce Extract.

- The signatures should correspond with the signature on the ID document provided.

Cash Management Solutions

I’m an existing client of BNP Paribas in the Netherlands and would like to open an additional account. What am I required to provide?

Should you already have an account with BNP Paribas NL, please send us the following documentation:

- Account opening request letter, stating the currency and quantity of the new account(s) duly signed.

How do I close an account?

In order to close a current account, please, send us a duly signed Account Closing Request Letter to nl.cep.referential.team@bnpparibas.com. In case the account is in name of a company registered outside the Netherlands, please, also send us a Chamber of Commerce extract not older than three months.

Depending on the situation, we might also request you a FATCA/AEOI form and a valid copy ID (in PDF) of the legal representative signing the Account Closing Request Letter. If these documents are needed, we will inform you as a follow-up to your request.

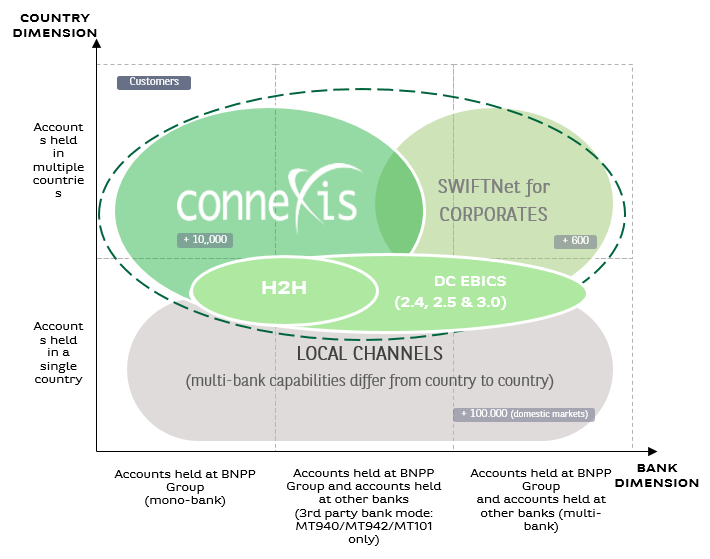

What kind of E-banking solution suits my company best?

We offer a number of E-banking solutions tailored to your needs. In the graph below you can quickly see which solution suits you best on the basis of your geographical and banking needs. For fully tailored advice you can also reach out to your relationship manager or cash management officer.

What is Connexis?

Connexis Cash is BNP Paribas’ global E-banking solution, addressing both global and local Cash Management needs. It provides complete visibility and control over accounts worldwide and a full range of domestic and international cash services. Connexis Cash grants access to BNP Paribas accounts and to third-party banks information.

Find more about our service with a Connexis Cash Flash Demo and the Connexis Cash brochure.

Is reporting available in Connexis?

Yes, access to reporting is on a real-time basis and transactions are processed STP (Straight Through Processing). Reports are provided in Ledger and Value modes and are available for one year. You can also export reports to your accounting system using local and industry standards.

Can I create my own reports in Connexis?

Yes, you can customize reports to your needs. create your own report lists, choose currencies and foreign exchange rates. You can also make customized, exportable reporting statements in Excel and PDF.

Is Connexis able to handle large volumes and connect to our ERP system (treasury system)?

Connexis Cash is designed to handle large volumes of data, and our tailored solutions are fully integrated with Treasury systems. you can fully automate the file transfers between your system and the bank under a “Host to Host” mode.

Can I make use of Manual Payment Instructions?

BNP Paribas SA only offers this service in contingencies only i.e.: if all electronic channels are temporarily offline. Do reach out to your Relationship Manager or Cash Management Officer for more information.

Does BNP Paribas have Standard Settlement Instructions?

Yes, the Standard Settlement Instructions is on our website.

What are the Cut-Off Times for payments (inbound and outbound)?

You can check our Cut-Off Times for payments on our website.

Are there tools to support me with my international payments?

Yes, Swift GPI tracker is a very useful tool is available for real time end-to-end tracking of your incoming and outgoing international Swift payments. The SWIFT Global Payment Innovation (GPI) initiative also provides transaction fee and FX transparency. You can even send your beneficiary a link (‘BENE Tracker’) in a secure environment, to trace the live status and details of their specific incoming payment. SWIFT GPI information can be accessed through various channels, such as via our online banking tool Connexis Cash, via Connexis Gateway and also via host-to-host channels such as SWIFTNet, DC FTPS / SFTP, DC EBICS. This is referred to as ‘G4C’. G4C allows you to receive Swift GPI information directly into your Enterprise Resource Planning (ERP) or Treasury Management System (TMS).

Additionally, the BNP Paribas Currency Guide helps you with managing the uncertainty and complexity of making international payments. It contains both practical guidelines and exhaustive data on more than 130 currencies. You can access the Currency Guide to find more about the topic.

Finally, you can subscribe to our Cash Management Newsfeed by leaving your email address on the BNP Paribas Cash Management website. This way you will always receive the latest updates on the BNP Paribas Currency Guide, as well as other articles and information on cash management topics.

What is a Standard Bank Confirmation?

A Standard Bank Confirmation is used by auditors to verify the financial statements of a company. The content of the Standard Bank Confirmation provided by BNP Paribas Netherlands is aligned with the requirements of the Royal Netherlands Institute of Chartered Accountants (NBA).

How can I apply for a Standard Bank Confirmation?

If your auditor accepts the possibility to upload your request via the Confirmation.com portal, please, send us your request via this portal. We will process your request and share the confirmation with your auditor directly online, through this application.

If your auditor does not accept the use of the Confirmation.com portal, you can complete the following request template. A separate Standard Bank Confirmation form is required for each legal entity.

After completing this request in full, please duly sign it and e-mail it to: europe.cib.gb.audit.confirm@bnpparibas.com.

Standard Bank Confirmation with a closing date in the future, will be sent to the requesting company and their auditor within 4 weeks after the specified reference date. All other requests will be handled within 4 weeks after receipt of the completed and duly signed application.

If you have specific questions on this subject, please contact: europe.cib.gb.audit.confirm@bnpparibas.com

How can I request an Account Confirmation Letter?

You can obtain a standard Account Confirmation Letter (RIB) yourself, free of charge, by downloading it through the following link:My Documents

In case you prefer BNP Paribas Netherlands to issue an Account Confirmation Letter for you, we are happy to do so at a fee of €25.00 per letter.

You can request an Account Confirmation Letter to nl.cep.referential.team@bnpparibas.com including the following information in your email:

- Entity name for which the letter is issued;

- Full name and telephone number of the contact person at the addressee (for registered mail)

BNP Paribas Netherlands will issue your Account Confirmation Letter within 5 working days after receiving this information.

How can I receive my official bank reports – such as Account Statements or Interest Statements?

You can find many of your official reports in the My Documents App, which can be accessed via CENTRIC. If you do not have access yet, please contact our Cash Management Client Support team (cm.clientsupport@bnpparibas.com) or your regular Cash Management contact.

Our account was credited in relation to an unsuccessful Sepa Credit Transfer (SCT) that we submitted earlier. Why was this SCT returned?

SCTs can be unsuccessful for various reasons. In the description of the reversal booking of the transaction you will find a reason code. These codes are standardized within the SEPA scheme and indicate the reason for an unsuccessful Sepa Credit Transfer.

Our account was debited in relation to an unsuccessful Sepa Direct Debit (SDD) that we submitted earlier. Why was this SDD reversed?

SDDs can be unsuccessful for various reasons. In the description of the reversal booking of the transaction you will find a SDD code. These codes are standardized within the SEPA scheme and indicate the reason for an unsuccessful direct debit request. You can find the list of reason codes with their description

How can I request a LOG?

BNPP Paribas Netherlands offers their clients the service of providing a Letter of Good standing. The standard charge for such a letter is EUR 75,00.

To request a Letter of Good Standing, please send an email to:nl.cep.referential.team@bnpparibas.com

-For BNP Paribas to issue a Letter of Good Standing the following information is required:

-Entity name on behalf of which the letter is issued;

-Purpose for which the letter is issued (e.g. description of the project);

-Name of the addressee;

-Address to send the letter to;

-For registered mail, full name and telephone number of the contact person at the addressee.

BNP Paribas Netherlands issues these letters within 5 working days after receiving all of the above information.

Global Trade Solutions

Does BNP Paribas SA Netherlands have a Standard Price list for Trade Finance products?

Yes, download the price list here. You can also request an additional copy of an issued guarantee at the cost of €25.00 per copy by sending an email to nl.guarantees.service.center@bnpparibas.com.

I do not make use of BNP Paribas e-banking channels yet. Can I initiate Trade Finance transactions manually?

Yes, you can use the following forms to manually initiate your Trade Finance Transactions.

Please, keep in mind that in order to use one of this form, it is important to have your signatories correctly registered with us. You can find more information on this, read about registering new signatories below.

For more information about the acceptance of digital signatures, please check the dedicated section on this portal.

How can I register a new signatory?

Please use this form to register your new or updated signatories.

The new or updated signature card should be duly signed on behalf of your company.

Please send the PDF version, together with a valid passport copy of the newly added signatories to the following email address: nl.cep.referential.team@bnpparibas.com.

For more information about the acceptance of digital signatures, please check the dedicated section on this portal.

How can I request a Letter of Credit?

Please send the duly signed Letter of Credit form in PDF format to gts-amsterdam@bnpparibas.com.

How can I request a Export Collection Request form?

Please send the duly signed Export Collection Request form in PDF format to gts-amsterdam@bnpparibas.com.

How can I request a new Guarantee Issuance?

Please send the duly signed Guarantee Issuance form in PDF format to nl.guarantees.service.center@bnpparibas.com.

How can I request the amendment of a Guarantee?

Please send the duly signed form in PDF format to nl.guarantees.service.center@bnpparibas.com.

How can I request a Text Review?

Please send this form in PDF format and the text in word format to nl.guarantees.service.center@bnpparibas.com.

General Information

Does BNP Paribas SA Netherlands accept e-signatures?

Yes, under certain conditions. Please, contact your service desk at cm.clientsupport@bnpparibas.com or ccs@bnpparibas.com for more information and before you sign electronically.

How do I change a postal, statement or registered address?

In order to change a postal or statement address, please send us a duly signed letter to nl.cep.referential.team@bnpparibas.com.

If the registered address of your company has changed, please, send us a Chamber of Commerce extract not older than three months to nl.cep.referential.team@bnpparibas.com.

How do I register a name change?

If you would like to change the name of your company in our records, please send us an email request with Chamber of Commerce extract showing the new name, Articles of Association mentioning the new name and the reason for the name change to nl.cep.referential.team@bnpparibas.com.

If the reason for the name change is that the company merged, then please also send us a merger agreement.

What are the bank holidays in 2025?

Complaints

Offering you the best quality of service and thus ensuring your satisfaction is at the heart of BNP Paribas’s concerns.

If you have any dissatisfaction you wish to share with us, please contact us to clarify the situation. We will provide you with an adequate response free of charge.