BNP Paribas’ Securities Services (BNP Paribas), a leading European provider of custody and investment services, has been appointed by Stichting Oak Pensioenfonds (Oak Pensioenfonds) as its global custodian and administrator. Through this partnership, Oak Pensioenfonds entrusts BNP Paribas with the custody and administration of its total invested assets of € 5.4 billion (as of December 2024). The services include custody, investment administration, investment compliance, performance measurement and regulatory reporting.

After a careful selection process, Oak Pensioenfonds selected BNP Paribas for its strong local presence, in-depth knowledge of the Dutch pension sector, expertise about the implementation of the Wet toekomst pensioenen (Future Pensions Act), and a proven track record in supporting complex transitions.

“We are delighted to support Oak Pensioenfonds during this important phase of change,” said Mark Schilstra, Head of Securities Services Netherlands at BNP Paribas. “Our dedicated local team, backed by senior management commitment and our European scale, ensures a smooth onboarding process and a long-term partnership. This mandate confirms our ability to effectively support Dutch pension funds in a dynamic market environment.”

Paul de Geus, executive board member of Oak Pensioenfonds, commented, “In selecting a new service provider, we were looking for a party with in-depth knowledge of the Dutch market and the changing pension legislation. BNP Paribas not only showed a convincing transition and implementation plan, but also demonstrated strong local commitment and investment in relationship management. Choosing a European provider with relevant references gave us confidence that they are the right partner for us.”

The onboarding and migration process is now underway, with the go-live scheduled for 1 July 2025.

With this partnership, BNP Paribas underlines its commitment to the Dutch pension market and its ambition to be the leading European partner for institutional investors navigating regulatory and operational challenges.

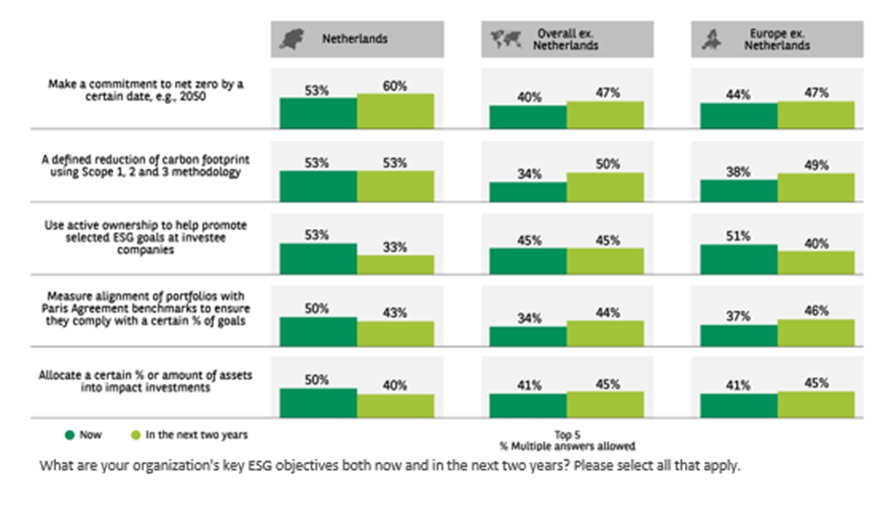

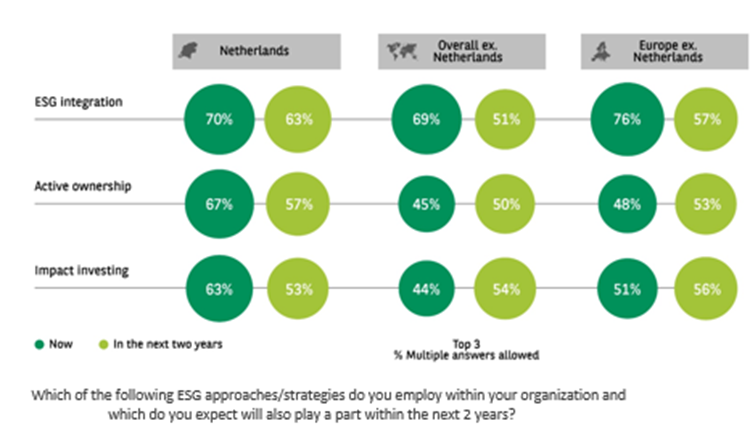

Among Dutch investors, the popularity of active ownership as a means to promote ESG goals at investee companies is declining. The number of Dutch institutional investors that name active ownership as a key ESG objective has decreased from 53% to 33%. This became apparent in the recently published biennial ESG Global Survey by BNP Paribas. The research report discusses the strategies that institutional investors over the world apply to become more sustainable and the obstacles they face in this process.

More often than their international peers, Dutch investors say they apply active shareholding as an ESG strategy. However, the study demonstrates that they will be losing their position as front-runners over the next two years. In addition to active ownership, support for ESG integration and impact investments is also expected to fall over the coming two years. A potential explanation might be that respondents perceive ESG integration as a hygiene factor and therefore self-evident.

Globally, the active ESG approach is gaining popularity

The survey shows that globally, 41% of investors have set themselves the goal of reducing net carbon emissions to zero by a certain date, such as 2050. In two years, this will be almost half (47%) of investors. In recent years, institutional investors have picked the ‘low-hanging fruit’ by using sustainability criteria to exclude the worst-performing companies from investments. These exclusions are a passive ESG approach. The next step in making portfolios more sustainable is switching to active investment strategies, such as impact investing, thematic investing and active ownership.

The question is how this trend will develop in the future. The Netherlands is seen as a pioneer in the field of sustainable investing, so it is questionable whether the move away from active ownership will also attract followers in the rest of the world. Time and the results of the next ESG Global Survey will tell.

About the ESG Global Survey 2023

BNP Paribas releases the ESG Global Survey every two years. This research focuses on how institutional investors from Europe, the APEC, and North America are faring on the path to sustainability. In 2023, the focus was on the strategies that institutional investors apply to invest sustainably and the obstacles they encounter. A total of 420 respondents worldwide participated, including 30 Dutch institutional investors.

The Securities Services arm of BNP Paribas, a leading global custodian with over EUR 12,000 billion of assets under management, has been appointed by Monuta Verzekeringen NV (Monuta) to provide global custodian services for Monuta’s total invested capital of EUR 1.9 billion (as at 31 December 2023). In addition, BNP Paribas will provide financial and investment administration and regulatory reporting (including Solvency II) for Monuta.

Monuta specialises in arranging and insuring funerals. Established in 1923, the company is one of the leading players in the funeral sector in the Netherlands, with 1.4 million policyholders. The services provided by BNP Paribas, which Monuta will be utilising, are targeted towards the Dutch institutional investor. This involves tapping into the expertise of BNP Paribas’ operational and relationship management teams in Amsterdam.

“For over 100 years, the same mission has driven us at Monuta: we will do all we can to make every farewell feel good. This includes taking care of our customers from a financial and sustainability perspective, not only now, but also in the future. That is why we continuously renew and strengthen our approach. We are very pleased to have found BNP Paribas as a suitable partner in custody services and investment and sustainability reporting. We have successfully completed the migration and look forward to a fruitful collaboration.”

Ilse van den Bosch, CFRO of Monuta

“We are delighted that Monuta has selected us as their new asset services provider in the Dutch market. Winning this mandate once again demonstrates our strong position in the Netherlands and our ability to offer front-to-back solutions tailored to the needs of our insurance clients.”

Mark Schilstra, Head Securities Services Netherlands and Scandinavia of BNP Paribas

Amsterdam, 8 January 2024 – Hugo Peek has been appointed Chief Executive Officer (CEO) of Corporate and Institutional Banking (CIB) and Country Head of BNP Paribas The Netherlands, effective 15 January. He succeeds Geert Lippens who has been appointed Head of Corporate & Institutional Banking EMEA countries at BNP Paribas.

Hugo Peek will lead the Dutch BNP Paribas Corporate & Institutional Banking team and will also oversee all the BNP Paribas entities in the Netherlands, including Corporate & Institutional Banking, Securities Services, Asset Management, Arval (mobility solutions), Leasing Solutions, Personal Finance (consumer credit), Factor (factoring), Cardif (insurance), Wealth Management and Real Estate (real estate advisory). BNP Paribas has shown strong growth in the Netherlands the last few years and is now the largest international bank in the Dutch market with over 1.500 employees spread across nine entities. The Netherlands is a growth country for BNP Paribas with a longstanding presence of over 150 years and a strong support towards our Dutch clients.

Hugo Peek has years of experience in financial services. Most recently, he was Partner at boutique corporate finance advisory firm ACE Advisory and Head of Private Debt at DIF Capital Partners. For a significant part of his career, Hugo Peek was with ABN AMRO where he held various senior positions in both Amsterdam and London. In his last position at ABN AMRO, he was CEO of Corporate & Institutional Banking for the EMEA region. Hugo Peek also held several non-executive board positions in recent years, including in private banking, impact investing and the parking technology industry.

As part of his new EMEA position, Geert Lippens will stay closely involved as non-executive Chairman for BNP Paribas The Netherlands and will continue to sponsor a number of client relationships in the Dutch market.

“We are very pleased with Hugo Peek joining us as the new CEO for BNP Paribas in the Netherlands. With his years of broad experience in the financial sector and his strong leadership qualities, Hugo Peek is an excellent fit to continue to support our clients in the Netherlands as they navigate a changing marketplace by leveraging BNP Paribas’ broad expertise, sustainable development solutions, and international network. Under his leadership, we will further strengthen our position in the Netherlands and continue to play an active role in the Dutch economy and society.”

Geert Lippens, Head of Corporate & Institutional Banking EMEA countries

“I very much look forward to starting at BNP Paribas to continue the growth path started under Geert’s leadership and help bring the company to the next level in the Dutch market. I can’t wait to get to know and collaborate with my new colleagues to further unlock the full potential of the Dutch entities and BNP Paribas Group for Dutch clients.”

Hugo Peek

Amsterdam and Leiden, 18 December 2023 – Naturalis Biodiversity Center and BNP Paribas signed a multi-year partnership for the protection and restoration of biodiversity. The urgency is high, particularly in the Netherlands, explains Edwin van Huis, Director of Naturalis Biodiversity Center: “The Netherlands stands out in terms of biodiversity loss. Within the European Union, only Belgium and Malta fare worse. The partnership with BNP Paribas allows us to make concrete impact on protecting biodiversity.”

The partnership brings together one of the world’s leading biodiversity knowledge centers with the European Union’s largest bank and a recognized leader in sustainable finance. Naturalis contributes deep scientific expertise. BNP Paribas brings access to a broad network of clients, partners and financial experts. Through the collaboration, the partners aim to translate Naturalis’s scientific expertise and insights into concrete, positive outcomes on the ground.

The collaboration aims to contribute to the protection of the world’s natural capital in four areas:

- Research & Data

- Education & Awareness

- Financial Innovation: accelerating the development of tools to direct more capital towards the protection and restoration of biodiversity

- Science-based metrics for decision-making in finance and business

“Naturalis works towards biodiversity protection through monitoring and scientific research. BNP Paribas is committed to helping protect biodiversity across the world through the implementation of specific policies, participation in coalitions, and financing actions with a positive impact. By joining forces with Naturalis, we have the opportunity to help our clients better understand and map their impacts and dependencies on nature – and thereby lay the foundation for businesses to take concrete steps, like optimizing strategies or policies to protect and restore biodiversity.”

geert lippens, CEO & Country Head at BNP Paribas Netherlands

““BNP Paribas has strong contacts in the business community – an important group that we need work with to turn the tide – and this partnership makes it possible share our data with them. Building awareness of this in the corporate world is the first step toward addressing the related business risks and opportunities. Additionally, through our collaboration, we can learn from BNP Paribas’ experiences with clients – what motivates or holds them back from accelerating the restoration of biodiversity. BNP Paribas also gives us access to information on risk management and biodiversity reporting through its active participation in the Taskforce on Nature-Related Financial Disclosures.”

Edwin van Huis, General Director of Naturalis Biodiversity Center

During the official launch on December 15 at Naturalis in Leiden, Koos Biesmeijer, Scientific Director, delivered a keynote speech outlining not what biodiversity is and the threats to it, but also emphasizing that biodiversity is essential for our life on this planet. Biodiversity gives us food and drinking water; it protects our coast and pollinates our crops and so much more, with a total value that’s many times greater than all the economic activity that we create ourselves. Making nature our partner is the only option for a livable future, he emphasized. During the event, clients of BNP Paribas and Naturalis also engaged in discussions with leaders and biodiversity experts from Naturalis and BNP Paribas to discuss their challenges and ambitions in the field of biodiversity. These formed the first steps towards further shaping the partnership establishing concrete objectives within the targeted impact areas.

Francine Hijmans, Dagmar van der Plas, Bouchra Filali, Benoit Saint Jevin, Claudia Belli.

*BNP Paribas has been a part of the TNFD since 2021.

BNP Paribas Securities Services, a leading global custodian with EUR 11.1 trillion in assets under custody, has been appointed by ASN Impact Investors (ASN) to provide global custody services for ASN’s total invested assets of EUR 4.2 billion (as of 30 June 2023). BNP Paribas already provides services for ASN in the areas of financial and investment administration and related reporting and (statutory) accounting.

ASN draws on the global expertise of BNP Paribas Securities Services and will be supported by the operational and relationship management teams in Amsterdam. Founded in 1993, ASN Impact Investors manages sustainable investment funds with an innovative strategy, including the ASN Biodiversity Fund, which invests in protecting and restoring biodiversity worldwide. With its investment policy, ASN focuses on companies and projects with good financial prospects that accelerate the transition to a sustainable world with future-proof business activities.

‘We believe that companies, governments, and projects, that in addition to a good financial result also positively contribute to climate, biodiversity, and human rights, are the future. We therefore want to work with partners that have a similar commitment and who are truly committed to a sustainable world. We are convinced that we have found this in BNP Paribas Securities Services. Hence, we have confidence in a longstanding and fruitful collaboration.’

San Lie

CEO of ASN Impact Investors

We are very pleased that ASN Impact Investors has chosen us as their new custody services provider in the Dutch market. ASN’s choice for BNP Paribas highlights our strong position in the Netherlands and our ability to provide front-to-back solutions tailored to the needs of our Asset Manager relations

Mark Schilstra

Head of BNP Paribas Securities Services the Netherlands and Scandinavia

Dynamic Credit maps climate risk of its mortgage portfolio

- An analysis by asset manager and mortgage lender Dynamic Credit shows that over a quarter of Dutch homes are exposed to climate risks if the global temperature by 2050 already rises above two degrees.

- Extreme weather conditions pose the greatest danger, with an increased risk for about 12% of homes. In combination with insufficient drainage extreme weather can lead to local flooding.

- Other climate risks taken into account in the analysis are flooding due to rising sea levels or higher water levels in the Dutch river basins (about 7% of homes), the consequences of longer periods of drought such as wildfires (about 1%), soil subsidence (6%), and foundation damage (about 6%). Approximately 5% of Dutch homes are exposed to multiple climate risks.

Dynamic Credit, part of BNP Paribas Asset Management, has conducted an analysis of the impact of climate risks on Dutch homes if a global temperature rise of two degrees or more materializes by 2050. Based on the climate risks described in the Climate Effect Atlas, the study measures the impact for each home in portfolios managed by Dynamic Credit and benchmarks this to the Dutch housing market. The five climate risks being investigated are flooding, extreme weather, and the indirect consequences of drought such as wildfires, soil subsidence, and foundation damage.

The study shows that over 25% of homes in the Netherlands are exposed to one or more risks. With an exposure of almost 12%, the consequences of extreme weather pose the greatest risk. The consequences of extreme weather included in the analysis are a rapid rise in groundwater and flooding caused by insufficient drainage after heavy rainfall. The risk of flooding as a result of rising water levels in the Dutch river basins or sea level rise potentially impacts 7% of the homes in the portfolio. With less than 1% of Dutch houses exposed, wildfires pose to smallest risk in the analysis. Both soil subsidence and foundation damage because of drought are a considerable risk for about 6% of homes.

Although the analysis gives an idea of the number of homes exposed to climate risks, the costs and impact of different risks vary greatly. The number of homes potentially decreasing in value due to the consequences of soil subsidence is lower than those decreasing in value due to extreme weather, but the financial consequences can be significant if homeowners do not invest in strengthening the foundation in time.

BNP Paribas Asset Management Netherlands CEO Jan Lodewijk Roebroek: “In 2021, the European Central Bank

presented an action plan to integrate climate change into risk management. Pricing climate risk is not only an

important addition to risk models, it also makes the consequences of climate change tangible and contributes to

awareness among investors and consumers. On July 8, 2022, the ECB conducted a first climate stress test among

104 European banks. Dynamic Credit’s analysis responds to the ECB’s call for more research data and is an

important first exercise to investigate how climate risks can be valued on balance sheets.”

Tonko Gast, CEO of Dynamic Credit: “Our report is a first and is an important step in the way the financial sector

understands and manages climate risks. By combining advanced data analysis with our in-depth understanding

of the Dutch housing market, we provide institutional investors with insight into the extent to which their

mortgage portfolios are exposed to climate risks. This insight is not an end point, but rather the basis to start a

debate in the market about the housing market in the Netherlands in the future.”

The Climate Effect Atlas was developed on behalf of the Dutch Ministry of Infrastructure and Water Management in collaboration with various knowledge institutions and consultancy firms. The report uses future scenarios developed by the Royal Netherlands Meteorological Institute (KNMI). The future scenarios are published in the KNMI’14 report, which outlines four possible scenarios for the climate in 2050 based on global temperature rise

and changes in air circulation patterns. The scenario in which global warming is already two degrees warmer in 2050, compared to the average temperature between 1981 and 2010, is the most negative of the four scenarios.

NHG (executor of the National Mortgage Guarantee) has appointed BNP Paribas as custodian to provide securities custody services, conduct the investment and financial administration, and provide regulatory and sustainability reports. NHG has entrusted the management of its invested (guarantee) capital of 1.6 billion euros to two asset managers.

Bjorn Jonkergouw, Manager finance, risk, compliance & business support at NHG: “We have been looking for a new custodian that highly values quality of service and sustainability, where we connected well with the customer service team, and with whom we want to work long-term. After an extensive and intensive tender process, supported by Monique Goossens from SecValeur, we opted for BNP Paribas, which best met our requirements and expectations.”

Mark Schilstra, Head of Securities Services Netherlands & Nordics at BNP Paribas: “We are pleased that NHG has chosen us as its new custodian and administrator. This appointment underlines our strong market position in the Netherlands and our ability to provide innovative solutions for our individual clients. Through our local platform and expertise, we can meet the specific needs of NHG. We offer them the required financial infrastructure and management reports, which will provide them with daily insights into their outsourced asset management.”

BNP Paribas’s Securities Services business, a leading global custodian with EUR 11.1 trillion in assets under custody, has been mandated by Coöperatie Univé U.A., based in the Netherlands, to provide tailored investment and financial administration, regulatory reporting and global custody services for its EUR 1.3 billion global assets.

Univé, a cooperative insurance company offering car-, home- and health insurances including other services to their 1.6 million members, appointed Securities Services at BNP Paribas as their global custodian to provide tailor-made investment and financial administrative solutions, and make use of the local expertise of their operational and relationship management teams in Amsterdam.

Arjen Schouten, CFRO, Coöperatie Univé U.A,: “Univé is a cooperative that put their members at the forefront of their strategy. From our providers we expect that same client focussed approach. We are confident that in BNP Paribas Securities Services business we found a committed and experienced provider that meets this expectation. We look forward to an extended, successful and trustworthy relationship.“

Mark Schilstra, Country Head for Securities Services at BNP Paribas in The Netherlands and The Nordics, said: “We are delighted that Univé have chosen us as their new asset services provider in the Dutch market. This mandate win highlights our strong position in the Netherlands and ability to offer front-to-back solutions tailored towards our insurance clients’ needs.”

Since the beginning of 2022, advisers applying for Argenta mortgages have the possibility to quickly and easily apply for the BNP Paribas Cardif Suretyship. The two parties will also continue their partnership in 2023, adding a free desktop valuation from Calcasa for customers applying for an Argenta mortgage with a Suretyship from BNP Paribas Cardif until 1 May to make the mortgage process even more efficient.

The three parties thus strengthen the mortgage market together, thanks to BNP Paribas Cardif in The Netherlands years of experience with Suretyships combined with Argenta’s strong market position and Calcasa’s independent and fast desktop valuation.

Last year, Argenta bank has included BNP Paribas Cardif Suretyships in its mortgage process. This allows an adviser to arrange a Suretyship for customers taking out the Argenta mortgage easily, quickly and at a competitive rate. The Suretyship offers security and makes purchasing a home easier.

Together, the parties want to unburden the customer journey even further. Among other things, they do this by offering simple products and making the processes more efficient. This step will speed up the mortgage process even more by offering Calcasa’s desktop valuation online, so that the customer receives the valuation within four hours. Now these three parties have jointly launched a campaign to make these

simple processes even more prominent to and experienced by customers and advisers.

“Calcasa has developed the desktop valuation to provide consumers with a quick and reliable valuation.

A fully digital process for advisor and customer where the mortgage lender ultimately uses source data is

where we are heading in the market. The deployment of the desktop valuation in the adviser’s process

leads to time savings and hence faster clarity. The initiative with BNP Paribas Cardif and Argenta is a nice

collaboration in the chain and makes it even easier for the advisor and the customer”

Tijs Pellemans,General Director Calcasa.

“Argenta is a responsible, simple and price-conscious bank and continues to work on that. This promotion

of a free desktop valuation together with BNP Paribas Cardif and Calcasa fits our character perfectly. It

also shows how we can mean even more to customers and advisers through cooperation. In this way, we

want to continue to grow healthily in the Netherlands in the coming years, including productive cooperation

with our partners in the mortgage chain.”

Sander Blommaert, CEO Argenta Netherlands

“As the expert in Suretyships, BNP Paribas Cardif chooses to cooperate with partners in the mortgage

chain. The addition of Calcasa’s desktop valuation to the mortgage process with Argenta, fits seamlessly

with our partner strategy and makes insurance simple and therefore more accessible.

Guido Wassink, Head of Sales & Business Development at BNP Paribas Cardif in The Netherlands.