Political resistance to ESG concerns Dutch institutional investors

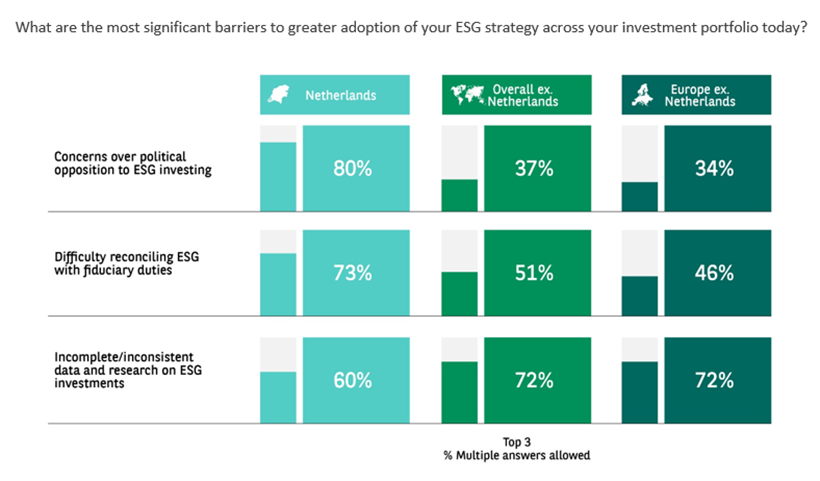

80% of Dutch institutional investors are concerned about political resistance to ESG. According to respondents, this is the main obstacle to implementing ESG measures. In other European countries, only 34% of institutional investors consider list this in the top three biggest obstacles. This emerges from BNP Paribas’ biennial ESG Global Survey. The research report describes the strategies that institutional investors around the world are using to become more sustainable, and the obstacles they encounter in doing so. Among other things, one of the potential problems Dutch institutional investors cite is the impact following adjustments to ESG legislation in the United States.

Furthermore, 73% of Dutch institutional investors questioned say they experience challenges in aligning ESG with their fiduciary duties. The Dutch Corporate Governance Code obliges Dutch companies to take environmental and social impacts into account in their business strategy.

Large majority of Dutch investors committed to climate goals

Despite the obstacles mentioned, investors continue to further develop their own ESG policies. Currently, 70% of Dutch investors are focusing on climate goals and reducing CO2 emissions. Additionally, six out of ten Dutch investors are committing to achieving net-zero by 2050 in the next two years,. Furthermore, the restoration and preservation of biodiversity is also becoming increasingly prominent on the agenda.

In the next two years, Dutch investors’ voting policies are expected to give greater priority to social issues such as diversity, equality, and inclusion. Following the significant strides companies have made in the areas of climate and environment, there is most room for improvement in these areas. Dutch investors appear to be filling the void created by the government not setting binding criteria for diversity in the workplace. The recently adopted Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosure Regulation (SFDR) by the European Union also strengthen the focus on social issues, as it increases the civil liability of companies for misconduct in their supply chain.

Dutch investors are vigilant about regulatory pressure

Dutch institutional investors are more vigilant than their European counterparts about the expected costs of implementing ESG legislation. 73% of respondents say they calculate the financial impact of increased regulatory pressure, compared to 59% of their international sector peers.

“We notice that Dutch investors come to us with questions about how they can implement ESG measures into their investments and how to measure and monitor them continuously. They seek structure in implementation and pragmatic tools for this. Although some aspects may be too complex to implement at present, most investors start with the feasible parts. This calls for a pragmatic approach.”

About the ESG Global Survey 2023

BNP Paribas releases the ESG Global Survey every two years. This research focuses on how institutional investors from Europe, the APAC, and North America are faring on the path to sustainability. In 2023, the focus was on the strategies that institutional investors apply to invest sustainably and the obstacles they encounter. A total of 420 respondents worldwide participated, including 30 Dutch institutional investors.